Appraisals give you useful information about the property and its worth. You’re entitled to know the value of your home. Whether you’re buying a home using a mortgage, refinancing your existing mortgage, or selling your home to anyone other than an all-cash buyer, a home appraisal is a key component of the transaction. Whether you’re a buyer, owner, or seller, you’ll want to understand how the appraisal process works and how an appraiser determines a home’s value.

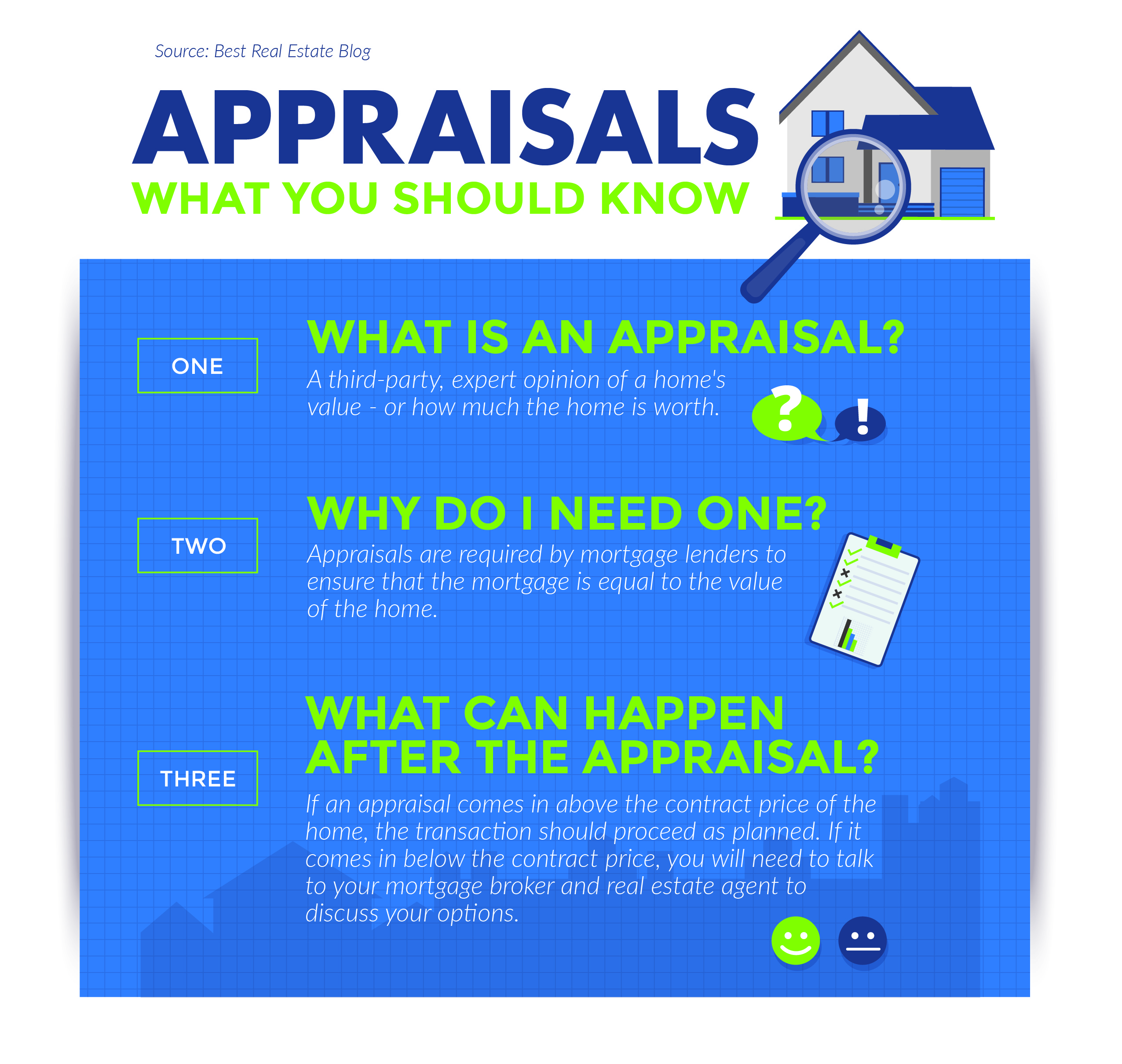

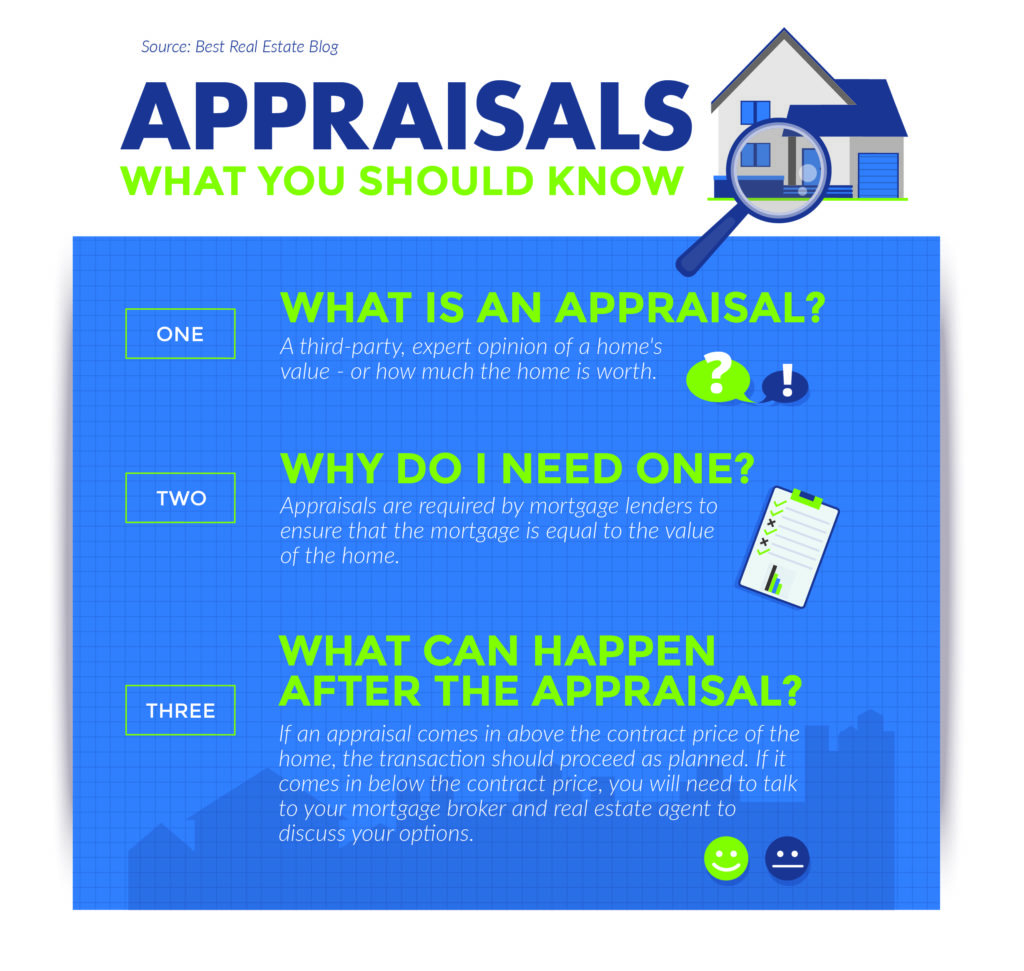

What Is a Simple Home Appraisal?

An appraisal is an unbiased professional opinion of a home’s value. Appraisals are almost always used in purchase-and-sale transactions and commonly used in refinance transactions. In a purchase-and-sale transaction, an appraisal is used to determine whether the home’s contract price is appropriate given the home’s condition, location, and features. In a refinance transaction, an appraisal assures the lender that it isn’t handing the borrower more money than the home is worth.

The Simple Appraisal Process and How Appraisal Values Are Simply Determined

Because the appraisal primarily protects the lender’s interests, the lender will order the appraisal. The cost of an appraisal depends on the type of property, e.g single family, multi-family, coop or condo, it ranges from $450- $700, the borrower pays this fee. Real estate appraisers must be licensed or certified—as required in all 50 states—and be familiar with the local area. Per federal regulations, the appraiser must be impartial and have no direct or indirect interest in the transaction. Fannie Mae requires appraisers to certify that they have experience appraising similar properties in the same geographic area.

A property’s appraisal value is influenced by recent sales of similar properties and by current market trends. The home’s amenities, the number of bedrooms and bathrooms, floor plan functionality, and square footage are also key factors in assessing the home’s value. The appraiser must do a complete visual inspection of the interior and exterior and note any conditions that adversely affect the property’s value, such as needed repairs.

Typically, appraisers use Fannie Mae’s Uniform Residential Appraisal Report for single-family homes. The report asks the appraiser to describe the interior and exterior of the property, the neighborhood, and nearby comparable sales. The appraiser then provides an analysis and conclusions about the property’s value based on his or her observations. The report must include a street map showing the appraised property and comparable sales used; an exterior building sketch; an explanation of how the square footage was calculated; photographs of the home’s front, back, and street scene; front exterior photographs of each comparable property used; and any other pertinent information—such as market sales data, public land records, and public tax records—that the appraiser requires to determine the property’s fair market value.

Lenders want to make sure that homeowners are not over-borrowing for a property because the home serves as collateral for the mortgage. If the borrower should default on the mortgage and go into foreclosure, the lender will sell the home to recoup the money it lent. The appraisal helps the bank protect itself against lending more than it might be able to recover in this worst-case scenario.