New Dwelling Mortgage Brokers

Use one of our quick and easy tools to shop mortgage options and competitive rates!

Why New Dwelling Mortgage?

At New Dwelling Mortgage, we offer a personalized approach that sets us apart as the ideal mortgage broker for home buyers. We believe a mortgage is more than a financial transaction—it's about building lasting relationships and helping you achieve your dream of homeownership.

When you choose us, you're not just selecting a broker; you're gaining a committed partner guiding you through every step. We prioritize education, ensuring you're informed about all loan options, empowering you to make decisions that align with your goals.

Our extensive network of wholesale lenders allows us to secure the most competitive terms, saving you time and money. We find the mortgage that best fits your needs, lifestyle, and budget.

From your first call to closing, you'll work with the same dedicated loan officer, ensuring consistent support and expert guidance throughout the process. Our goal is to make your home-buying journey smooth and stress-free, turning your dream of homeownership into a reality.

Mortgage Online Learning Center

Learn and Decide

We get that–you have a lot on your plate. However, we can provide you with the knowledge and tools to help you make an informed decision about your financial future. New Dwelling Mortgage provides accurate, up-to-date information regarding the mortgage process so that our clients can make educated decisions about their financial future.

Shopping For Homes?

Use this calculator to estimate your monthly mortgage payment, including taxes and insurance. Simply enter the price of the home, your down payment, and details about the home loan to calculate your payment breakdown, schedule, and more.

First Time Home Buyer?

Check out our articles to get you started on buying your first home.

Based on the New York, New Jersey, Colorado, and Florida Real Estate and Mortgage Industry.

4 Things to Know About Closing Costs

4 Things to Know About Closing Costs, whether you’re purchasing or refinancing a home, there is something called “closing cost.” Since closing costs differ based on location, property, and loan type, the borrower must receive an estimated amount they’ll be paying to determine what they can afford. Good News! Here at New Dwelling Mortgage, we don’t charge … Read more

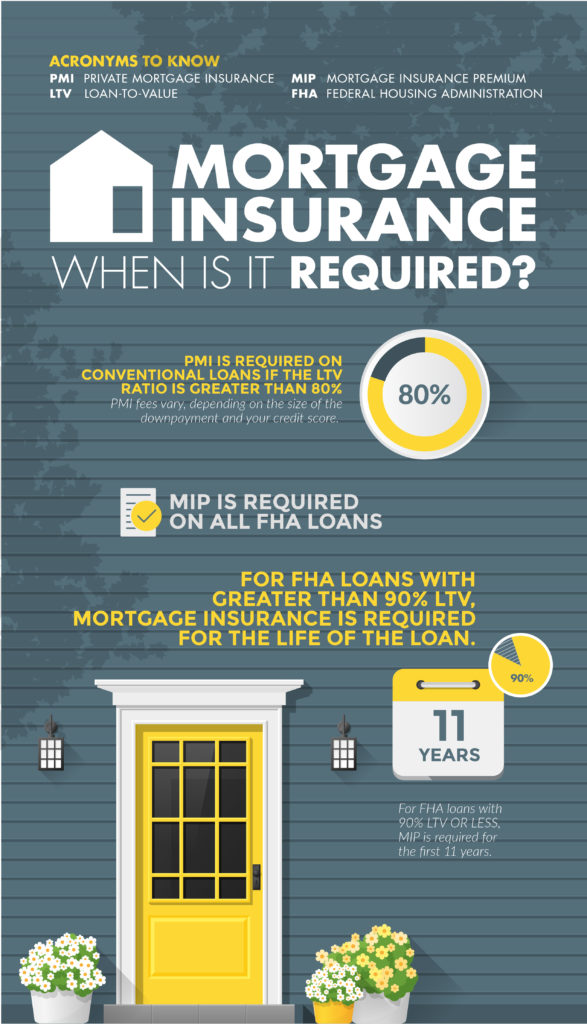

Mortgage Insurance, When do you need it?

Mortgage Insurance, when do you need it? PMI is required on conventional loans if the loan to value ratio is greater than 80%. MIP (Mortgage Insurance Premium) is required on all FHA loans. What Is Mortgage Insurance? If you’re making a down payment of less than 20% on a home, it’s essential to understand what mortgage … Read more