FAQs

You have reached our Frequently Asked Questions page. This section will find quick and easy reference articles and videos to help answer any questions you may have about the mortgage process and working with a mortgage company. The categories are sorted to make it easier to find what you are looking for. If you still have more questions or weren't able to find the answer, send us an email at start@newdwellingmortgage.com.

Want to Refinance? It’s Easy.

Want to lower your mortgage payment? ?… It’s easier than you think! Here are some of the benefits to Refinancing: ✅ Payoff credit card debt✅ Payoff a Home Equity line of credit ✅ Remove PMI (Private Mortgage Ins) ✅ Home Improvements ✅ Lower term and interest rate See how much you can save today! Click on the link below ? to begin the Home Refinance Analysis!

Read More4 Things to Know About Closing Costs

4 Things to Know About Closing Costs, whether you’re purchasing or refinancing a home, there is something called “closing cost.” Since closing costs differ based on location, property, and loan type, the borrower must receive an estimated amount they’ll be paying to determine what they can afford. Good News! Here at New Dwelling Mortgage, we don’t charge … Read more

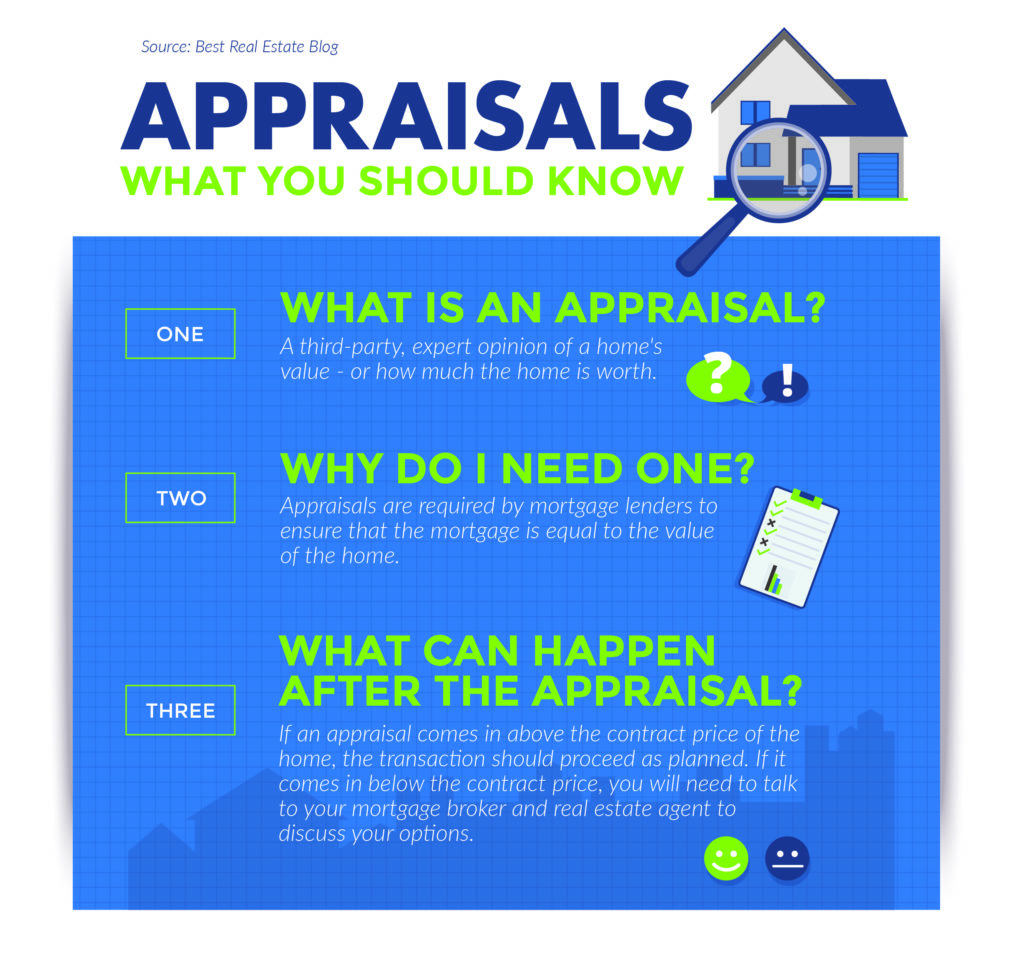

Read MoreWhat Is An Appraisal?

Appraisals give you useful information about the property and its worth. You’re entitled to know the value of your home. Whether you’re buying a home using a mortgage, refinancing your existing mortgage, or selling your home to anyone other than an all-cash buyer, a home appraisal is a key component of the transaction. Whether you’re a … Read more

Read MoreWhy Mortgage Brokers Are Better! – Video

Local independent mortgage brokers have access to wholesale interest rates, find the right mortgage for you, and can get you to the closing table in less than 20 days. Like a shipping tax, additional fees exist and could have you spending more money than you initially intended. Not to mention the delays. Mortgage brokers can … Read more

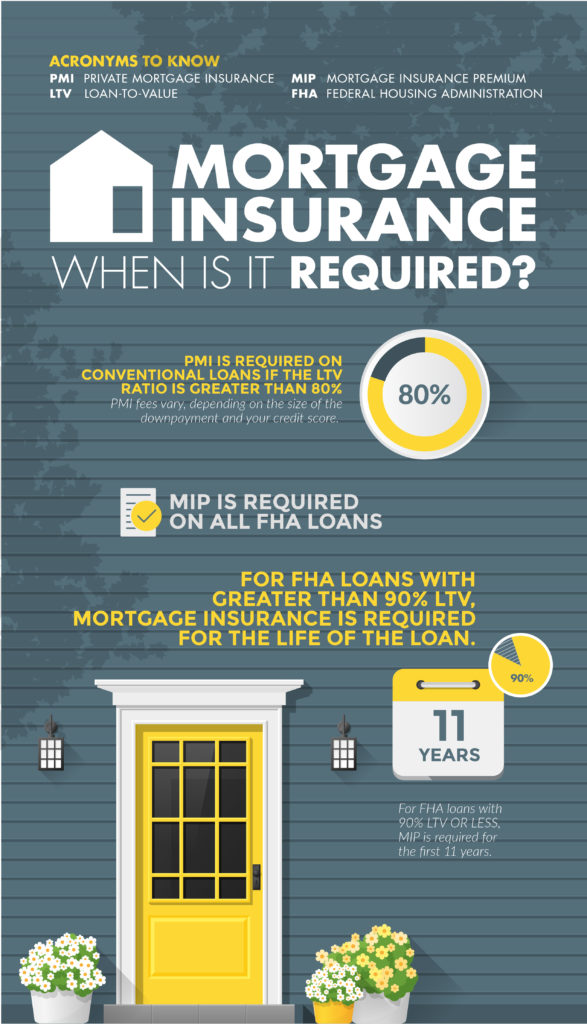

Read MoreMortgage Insurance, When do you need it?

Mortgage Insurance, when do you need it? PMI is required on conventional loans if the loan to value ratio is greater than 80%. MIP (Mortgage Insurance Premium) is required on all FHA loans. What Is Mortgage Insurance? If you’re making a down payment of less than 20% on a home, it’s essential to understand what mortgage … Read more

Read MoreIs a Mortgage Broker Right For You?

Is a Mortgage Broker Right For You? Are you having trouble deciding whether or not a mortgage broker is right for you? Here’s some useful information to help you make a decision! Mortgage brokers may provide more affordable costs compared to banks and mortgage banks. A mortgage brokerage firm is a licensed and regulated entity that brings borrowers and lenders … Read more

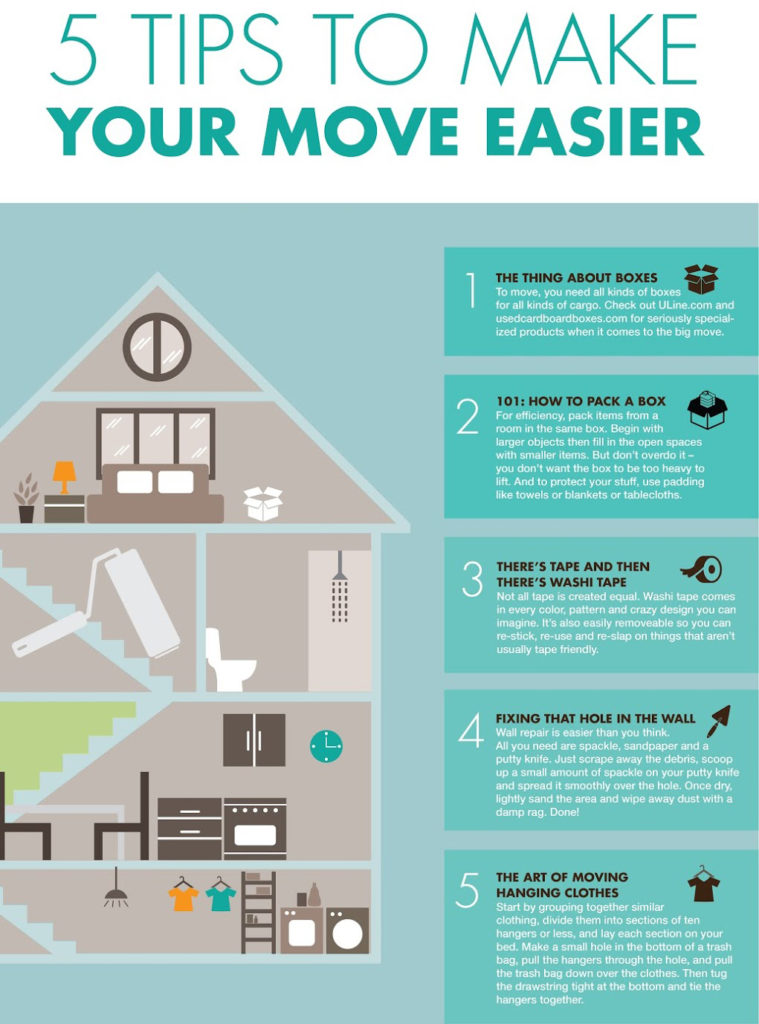

Read More5 Simple Tips to Moving

5 Simple Tips to Moving. If you’re stressing about your move, here are a few quick tips to make your move easier. Boxes. Make sure you have the right kind of packing containers for all the different types of cargo you’re planning on taking with you. Purchase various sizes of containers to ensure certain items … Read more

Read MoreSimple Basics to Buying a Home

Simple Basics to Buying a Home. Purchasing a home is exciting, but it can be overwhelming for a first time home buyer. It’s the largest purchase most people make in their lifetime. The good news is, you are not alone; it’s normal to feel this way. Understanding the process and knowing what to expect is vital! … Read more

Read More- « Previous

- 1

- 2

- 3

- 4